Student volunteer brings joy with wishing cranes

Carefully folded origami cranes carry messages of hope and healing, as one teen volunteer helps brighten patients’ days at Sharp Chula Vista Medical Center.

Although it may sound sweet, the "donut hole" in Medicare's prescription drug coverage can feel like a trap to those who fall into it. If you or a family member is covered by Medicare, and has prescription drug coverage, you should familiarize yourself with the coverage gap.

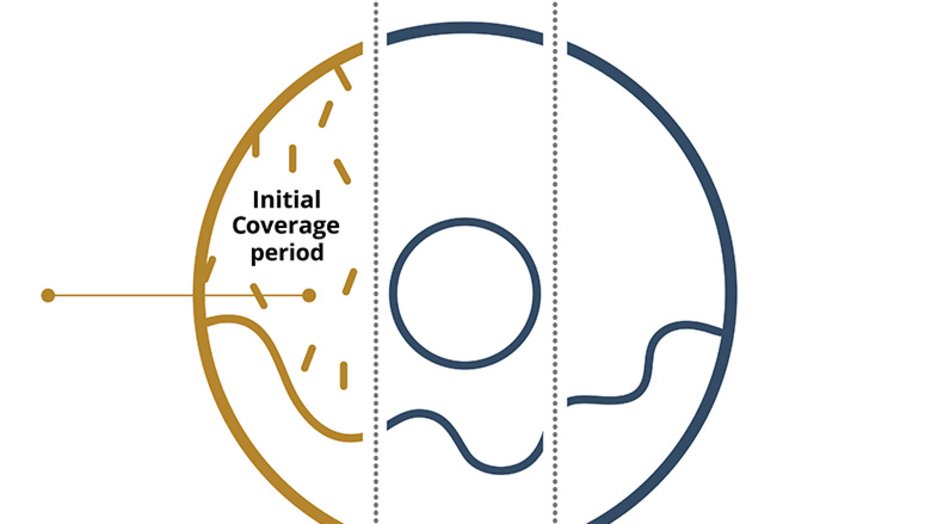

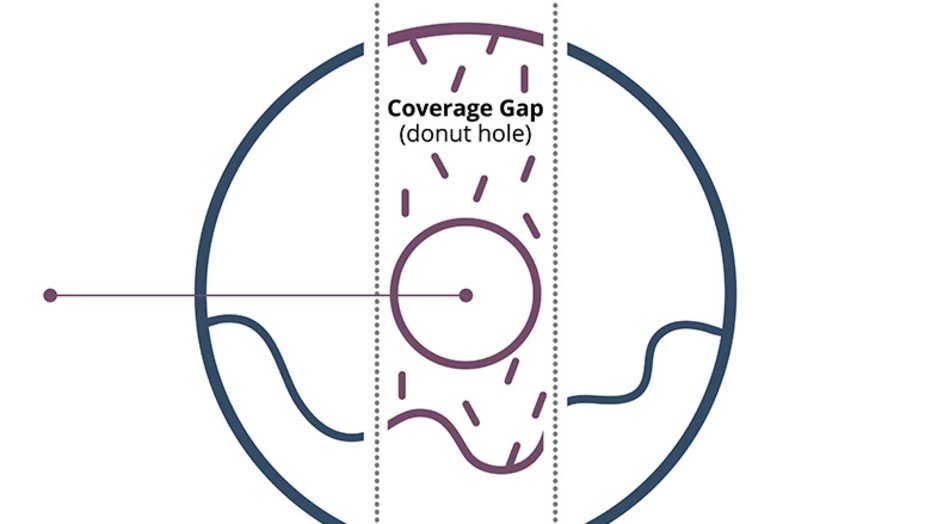

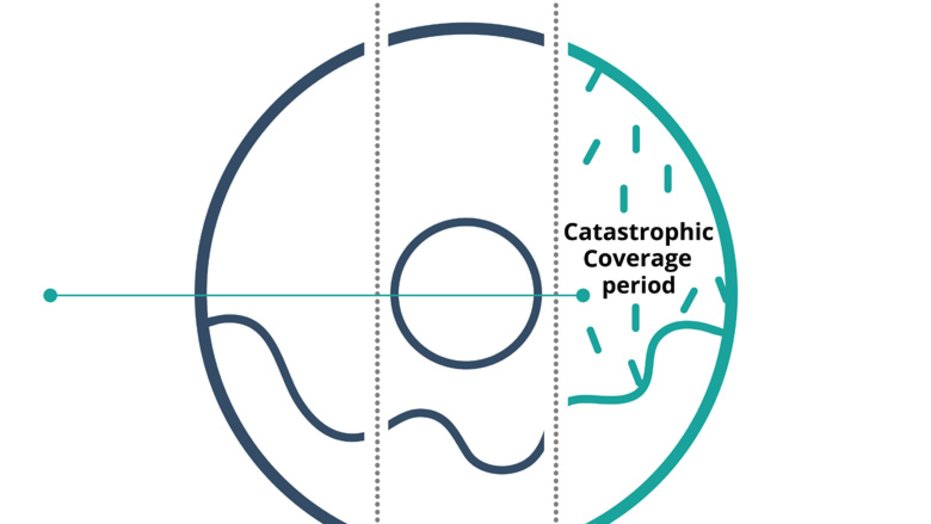

Visualize a donut: You have a left side, a hole in the middle and a right side.

Left side: You stay on the left side of the donut until your payments and your plan's payments reach $4,020* on covered prescription medications. This is not only what you pay personally at the pharmacy; this is the total of your covered drug costs plus your deductible and copays.

Hole in the middle: Once you reach $4,020 in drug costs this year, the coverage gap or "donut hole" phase of your Medicare plan begins. When in the "donut hole", you may pay 25% of the total cost of brand name drugs and a maximum of 25% of the total cost of generic drugs until your total annual costs reach $6,350.

Right side: After you reach $6,350 in the year, you leave the gap, and catastrophic coverage kicks in. In this stage, most will pay only a small coinsurance amount or copayment for covered drugs for the remainder of the calendar year.

Get the most out of your prescription drug benefits

No one wants to spend unnecessary money on prescription drugs. If you want to maximize your prescription drug benefits, consider these tips:

Switch to lower-cost drugs. Talk to your doctor about using generic or over-the-counter drugs.

Take advantage of mail-order prescription drug programs. Check to see if using a mail-order pharmacy for a three-month supply of maintenance drugs may lower your copayments (and help you avoid missing a refill).

Shop around and compare prices via retail and online stores. An in-network pharmacy may also save you money.

Finding the right prescription drug plan for you means doing your homework. Researching your plan's formulary, costs and benefits upfront will save you money and worry.

*These are the costs for 2020.

Still have questions about Medicare?

Sharp hosts free online seminars, where you'll learn more about enrollment periods and how Medicare works. Sign up for the "Understanding How Medicare Works" seminar or the "Understanding Your Medicare Open Enrollment Options" seminar.

These classes are also available in Spanish. Please visit Entienda Cómo Funciona Medicare and Entienda Sus Opciones de Medicare Durante la Inscripción Abierta for more information.

This story was updated February 4, 2021, to reflect the most up-to-date Medicare information.

Our weekly email brings you the latest health tips, recipes and stories.